Home / Medical Billing Time Limits by State

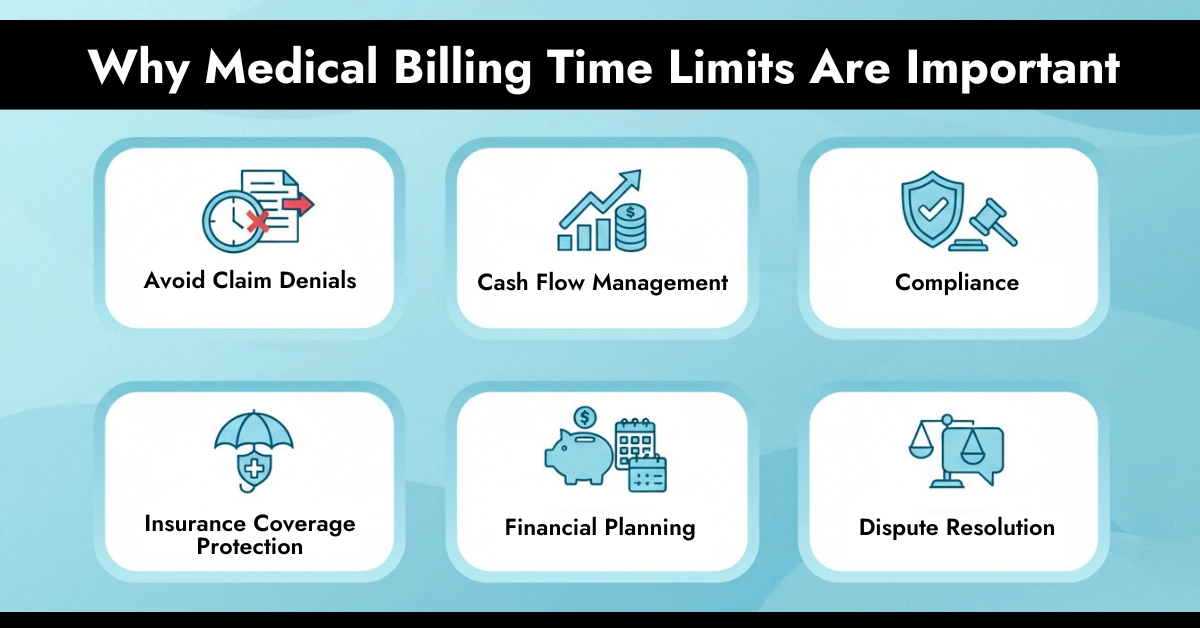

Understanding medical billing time limits by state isn’t just a regulatory checkbox. It’s about protecting money for healthcare providers and making sure patients aren’t overcharged. There are lots of timelines to keep track of, from how long you have to submit a claim to how long a debt can legally be collected. Because these deadlines can be different depending on the state or the insurance company, it’s important for both providers and patients to know the rules.

In this guide, we’ll break down the important deadlines, show how they can vary, and give some practical tips so nobody ends up losing money or getting stuck in a billing.

Medical billing time limits are simply the deadlines for when a healthcare provider must send your medical bill or insurance claim. They decide how long a doctor, hospital, or clinic has to bill you or your insurance after your treatment.

There are two primary deadlines you need to know about, each serving different purposes. Mixing them up can cost providers thousands of dollars in lost revenue and leave patients helpless to collection actions.

Did you know:

As of 2025, over 33 states have Medical Billing rules, but 18 states have comprehensive rules. If you live in California and Texas, the rules of Medical Billing can be strict; ignoring them could lead to bigger problems down the line.

Several factors influence the time limits for submitting medical claims:

State Regulations – Each state has laws governing how long claims can be submitted for Medicaid or state-regulated insurance plans.

Insurance Contracts – Private insurance plans often have their own contractual timeframes.

Type of Service – Emergency care, preventive services, or specialized treatments may have different limits.

Patient Responsibility – Claims can be delayed if the patient has not provided necessary documentation.

Understanding these factors helps providers and patients avoid claim rejections and financial loss.

Understanding medical billing deadlines across different states is essential for healthcare providers and patients. Here’s a state-by-state overview of Medicaid, Medicare, and private insurance filing limits, along with relevant statute of limitations for written contracts:

At Hello MDs, our credentialing and enrollment services ensure that each provider is properly enrolled in every state’s Medicaid program. We make sure that all filing requirements and deadlines are accurately met from day one, reducing the risk of claim denials and ensuring compliance with state-specific regulations.

CBS News reports that collectors may still attempt contact and payment requests, but they simply lack legal enforcement power, especially without a court judgment

Timely submission of claims, guided by medical billing time limits by state, is crucial for reimbursement. Our blog on How Out-of-Network Labs Can Get Paid shows how following state-specific deadlines ensures successful claim approval.

Knowing these misconceptions helps avoid costly mistakes for both providers and patients.

Both providers and patients should maintain:

Our medical billing audit services at Hello MDs include comprehensive documentation reviews that protect practices during disputes and audits.

Understanding medical billing time limits by state is critical for maintaining financial health, compliance, and peace of mind. Both healthcare providers and patients benefit from:

Whether you’re managing a private practice, working in a hospital, or handling your personal medical claims, being proactive about deadlines is essential. By staying informed, using technology, and keeping accurate records, you can ensure claims are processed efficiently and correctly—avoiding unnecessary delays and financial stress.

Disclaimer:

For general informational purposes only and not a substitute for professional medical or billing advice. Always confirm coding and billing details with certified experts or official guidelines. Any visuals provided are for illustrative purposes and may be computer-generated.

Providers must submit claims within state and payer-specific deadlines, usually 90-365 days, or Medicare’s 12-month limit. Missing deadlines may result in denied claims and lost payment.

It depends on your state’s statute of limitations. Many states limit lawsuits to 3-10 years. After that, debt is “time-barred” and unenforceable in court.

Bill submission deadlines apply to providers filing claims with insurers. Debt collection time limits (statute of limitations) govern how long providers can legally sue patients.

Yes. Each state sets its own time limits for medical debt, typically 3-10 years. Laws define when the clock starts, usually from the last payment or default.

Generally, the statute of limitations from the original treatment state applies. However, laws vary, so it’s crucial to check both states’ rules or seek legal advice.

Providers typically bill promptly (often within 30–120 days after service or insurance processing) to align with practical and payer requirements. Washington state has no strict statewide law capping how long a provider can take to send the initial bill to a patient for services. Excessive delays may raise consumer protection issues, but there's no hard cutoff like in some other states.

There is no fixed state law limiting how long providers have to send the first patient bill. In practice, most providers bill patients within months after the date of service or after insurance adjudication to avoid collection challenges. The key restriction is on collection actions: providers cannot assign debt to collectors until at least 120 days after the initial billing statement (RCW 70.54.470).

Yes — the statute of limitations for collecting unpaid medical debt in Washington is 6 years (RCW 4.16.040, treating it as a written contract or account). This clock generally starts from the date the debt became due (often the service date, bill issuance, or last payment/activity). After 6 years, the debt is time-barred, meaning providers/collectors cannot sue to enforce it (though voluntary collection attempts may still occur).

For insurance claims, timely filing limits are payer-specific: Apple Health (Medicaid) allows 365 days from date of service; Medicare typically 12 months; many private insurers allow 90–180 days. For patient billing, no strict state cap exists on initial bills, but providers must wait 120 days post-initial statement before assigning to collections.

Legal action to collect debt has a 6-year statute of limitations.

Providers must submit claims to insurance within payer-specific timely filing limits to avoid denial. In Washington: Apple Health (Medicaid) generally allows 365 days from the date of service for initial claims; Medicare is 12 months; commercial/private plans commonly allow 90–180 days (varies by insurer/contract). Missing these deadlines often means the provider cannot get reimbursed and may bill the patient directly for the full amount (subject to any contract restrictions).