Home / What is a Superbill in Medical Billing

You’ve just paid $300 for a specialist visit out-of-pocket, only to find your reimbursement claim denied months later because of an obscure form called a superbill. This scenario is all too common: many patients see out-of-network providers and then struggle to get paid back. In fact, the NPR report found that 28% of Americans receiving mental health therapy saw an out-of-network provider, meaning they had to pay up front and seek reimbursement afterward.

This is where understanding what is a superbill in medical billing is becomes critical. A superbill turns this frustration into a clear process. It’s essentially a highly detailed receipt that the provider gives the patient, packed with coded information about the visit. The superbill “is not really a bill at all,” but a highly detailed receipt itemizing the services provided, so the patient (not the provider) can be reimbursed by insurance.

A superbill is a comprehensive encounter form that captures every service, diagnosis, and charge from a patient visit. Unlike a standard invoice, it uses standardized medical billing codes to communicate directly with insurance payers. Think of it as a detailed translator between clinical care and financial reimbursement.

As defined by the American Academy of Professional Coders (AAPC), a superbill is “a one-page form that lists all possible services a provider delivers, allowing quick selection of CPT codes, ICD-10 codes, and fees.” This superbill definition clarifies its purpose: to facilitate accurate coding on a superbill for claims submission, especially for out-of-network providers who don’t bill insurance directly.

The document becomes critical when a provider chooses not to enrol with a payer or when a patient sees a specialist outside their network. In these cases, the healthcare superbill empowers patients to seek reimbursement themselves while providing insurers with the precise data they need to process payments.

A properly structured superbill in medical billing contains eight essential elements. Missing even one can derail reimbursement. Here’s what every medical billing superbill must include:

Superbills are a key part of medical billing, helping streamline patient-submitted and out-of-network claims. To see how they fit into the broader billing process, check out our guide on types of medical billing. Accurate coding on superbills ensures faster reimbursement and fewer claim denials.”

Understanding how to use a superbill reveals its role in the revenue cycle. The workflow follows in 5 steps:

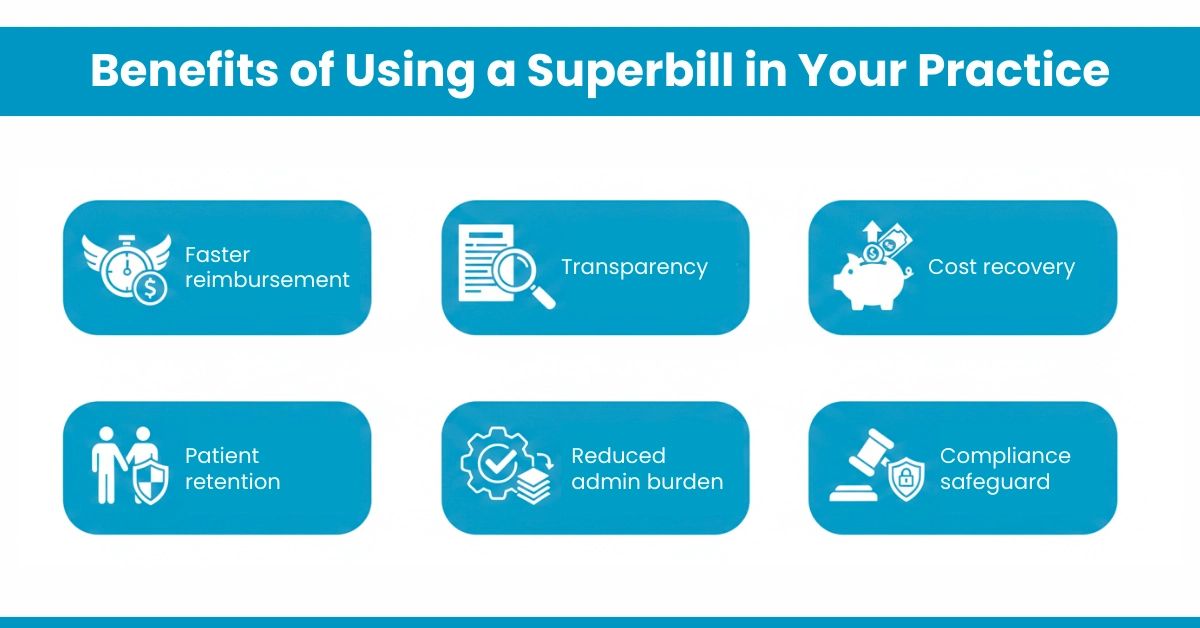

Whether you’re a solo therapist or a multi-specialty clinic, Superbill advantages ripple across your entire operation:

For Patients:

For Private Practices:

For Billing Teams:

For Healthcare Startups:

Practices using our physician billing services report 15-20% higher collection rates when superbills are optimised through our denial management protocols.

Even with clear benefits, superbill errors plague practices. Here are the top pitfalls:

Solution Path: In the denial management service provided by Hello MDs, we review rejected superbills within 48 hours, correcting errors and resubmitting. This proactive approach recovers $12,000+ monthly for average practices.

Follow these superbill best practices to maximize efficiency:

A superbill is more than paperwork; it’s the lifeline connecting patient care to insurance reimbursement. By capturing accurate components of a superbill, from CPT codes to provider signatures, practices empower patients while protecting revenue.

For private practices, it builds trust and retention. For billing teams, it reduces denials and burnout. For patients, it means money back in their pockets.

At Hello MDs, we transform superbill management through end-to-end RCM healthcare services. Our AAPC-certified coders handle everything from prior authorisation to denial management, ensuring your medical billing superbill process is seamless, compliant, and profitable.

Disclaimer:

This article is for general information only and does not replace professional medical, legal, or insurance advice. Insurance rules and reimbursement policies may vary, so always check with your provider or insurer. Some images are digitally created and used only for illustration purposes.

Patients submit superbills through their insurer’s online member portal, mobile app, or by mailing or faxing them to the payer’s claims department.

Most insurance plans require superbill submission within 90 to 180 days from the service date, though some allow up to one year.

Yes, most insurance companies accept superbills as supporting documentation for out-of-network reimbursement when all required information and codes are included accurately.

An insurance superbill is a one-to-two-page document listing provider details, patient information, CPT and ICD-10 codes, service dates, charges, and signatures.

A superbill is also called an encounter form, charge slip, fee ticket, or routing slip, depending on the healthcare practice and billing workflow used.