Note: Chiropractors often bill therapeutic activity services as part of patient rehabilitation. Proper use of CPT Code 97530 is critical in medical billing for chiropractors to ensure accurate claims and avoid reimbursement delays.

Home / Medical Billing for Chiropractor

Are you a chiropractor struggling to manage the increasing complexity of medical billing for chiropractor practice? Accurate billing today goes far beyond simply submitting claims. It requires a deep knowledge of chiropractic-specific coding rules, payer regulations, and strict documentation standards.

Many people assume that this practice is simple and easy, but in reality, it involves complex layers of CPT/ICD-10 codes, insurance-specific compliance requirements, and constant regulatory updates. As we move from 2025 to 2026, billing for chiropractic services has become more precise and heavily regulated than ever before. And do you know that practices lose an average of 15-20% of potential revenue due to coding errors, claim denials, and costing billions nationally?

Chiropractic billing is the process of submitting claims to insurance providers for services like spinal manipulations, evaluations and therapies. It ensures your practice gets reimbursed for treating conditions such as back pain or subluxations. Simply, chiropractic billing means the process of translating the clinical services provided during patient visits into standardized medical codes that insurance payers recognize and reimburse. For example, Medicare (Part B) covers only manual spinal manipulation for subluxations, not extras like X-rays or massages

But why does it matter? According to the Centers for Medicare & Medicaid Services (CMS), proper coding and documentation are essential for avoiding claim denials and audit risks.

Did You Know? According to Invensis Technology, outsourcing chiropractic billing can reduce claim denials by up to 80%, allowing you to focus on patient outcomes.

Accurate chiropractic billing is important for protecting your practice’s revenue, maintaining compliance and delivering a positive patient experience. Even a small billing error, such as CPT/ICD-10 codes, can create long-term financial and operational challenges

Accurate billing reduces revenue loss caused by coding errors and claim denials.

Proper CPT and ICD-10 coding are important for claim denial prevention in chiropractic billing. It improves first-pass claim acceptance and speeds up reimbursements.

Strong chiropractic billing compliance lowers the risk of audits and penalties while supporting adherence to Medicare, Medicaid and commercial payers guidelines

Clear and accurate billing prevents unexpected charges and strengthens patient confidence.

Consistent billing accuracy ensures steady cash flow and long-term chiropractic reimbursement impact on practice stability.

Hello MDs Advice: We regularly see practices that recover 20-30% more revenue simply by standardizing their documentation and verification workflows. The key is creating a system where billing accuracy becomes automatic, not an afterthought

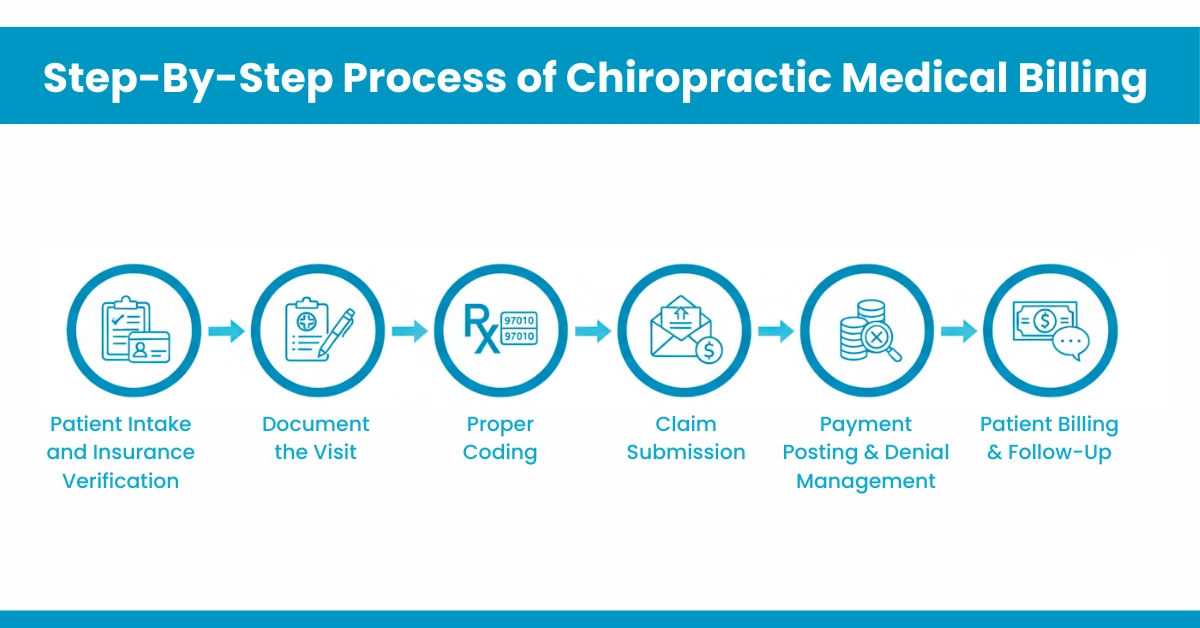

Navigating the chiropractor billing process doesn’t have to be overwhelming. Let’s break it down into clear steps for efficiency.

Start by collecting demographics and verifying coverage. Contact the insurance company to:

Confirm:

Tips for Efficiency:

At HelloMDs, our insurance eligibility verification for doctors and charge entry services ensure this process is seamless, helping chiropractors like you focus on adjustments rather than admin work.

Selecting the right codes is crucial for reimbursement. Here’s a breakdown of chiropractic CPT codes, ICD-10 codes for chiropractic services, and HCPCS codes for chiropractors.

Common spinal manipulation CPT codes include:

For E/M:

Therapies like 97110 (therapeutic exercise) and 97140 (manual therapy) are billed in 15-60 minutes.

ICD-10 codes for chiropractic services:

It is primarily from the M40-M99 (Musculoskeletal system & Connective tissue)

HCPCS codes for chiropractors primarily involve modifiers rather than separate codes. The AT modifier is crucial for Medicare claims, indicating active/corrective treatment rather than maintenance care.

Note: Chiropractors often bill therapeutic activity services as part of patient rehabilitation. Proper use of CPT Code 97530 is critical in medical billing for chiropractors to ensure accurate claims and avoid reimbursement delays.

Understanding chiropractic insurance billing is key to maximizing payouts. Medicare Part B covers manual manipulation of the spine to correct vertebral subluxation with supporting documentation. There is no hard 12-visit cap, though payers may institute review screens after frequent visits

Did You Know: Our prior authorization and RCM healthcare services navigate these rules, ensuring faster reimbursements and compliance.

Top chiropractic billing mistakes

HelloMDs’ medical billing audit services catch these early, while our account receivable team recovers underpayments efficiently.

In-House Billing Works When:

Outsourced Billing Makes Sense When:

Effective chiropractic billing is important to make sure your practice gets paid correctly, stays compliant, and runs smoothly. By following a clear process from patient intake and insurance checks to proper documentation, coding, claim submission, and payment posting. You can reduce claim denials, avoid losing revenue, and build patient trust.

Using tools like EHR systems, prior authorization services, and professional billing support makes the process faster and easier, letting you focus on patient care. Regular staff training, audits, and following insurance rules help your practice work efficiently and get the most out of every claim.

Disclaimer: This content is for general purposes only and does not replace professional billing or legal advice, just like Hello Mds provides. Some illustrations or graphics may be digitally created for demonstration purposes. Always verify coding and insurance rules with official sources and payer guidelines.

Yes. Chiropractic billing uses unique CPT codes (98940–98942), specific coverage rules, Medicare restrictions, spinal manipulation documentation, and required modifiers, which differ significantly from physical therapy billing practices.

No. E/M codes are only billable when a significant, separately identifiable evaluation beyond routine chiropractic manipulation occurs, and it must be fully documented in the patient record.

Medicare requires SOAP notes, a documented subluxation diagnosis, a treatment plan, progress notes, and the AT modifier to prove active, corrective care instead of maintenance therapy.

Electronic claims are typically processed in 14–30 days, while paper claims may take 30–45 days. Payment timing depends on claim accuracy and individual payer processing rules.

Denied claims can be corrected, resubmitted, or appealed. Common resolutions include adding missing modifiers, correcting diagnosis codes, or improving documentation to meet payer requirements.