Home / DFS appeal for labs

Out-of-network (OON) laboratories in New York often face challenges securing fair reimbursement from insurance companies. Studies show that OON labs experience up to 30% higher claim denials compared to in-network labs, particularly for services like colonoscopy panels, HEDIS quality measures, and advanced toxicology testing. Payment delays and underpayments are common when labs are not contracted with payers.

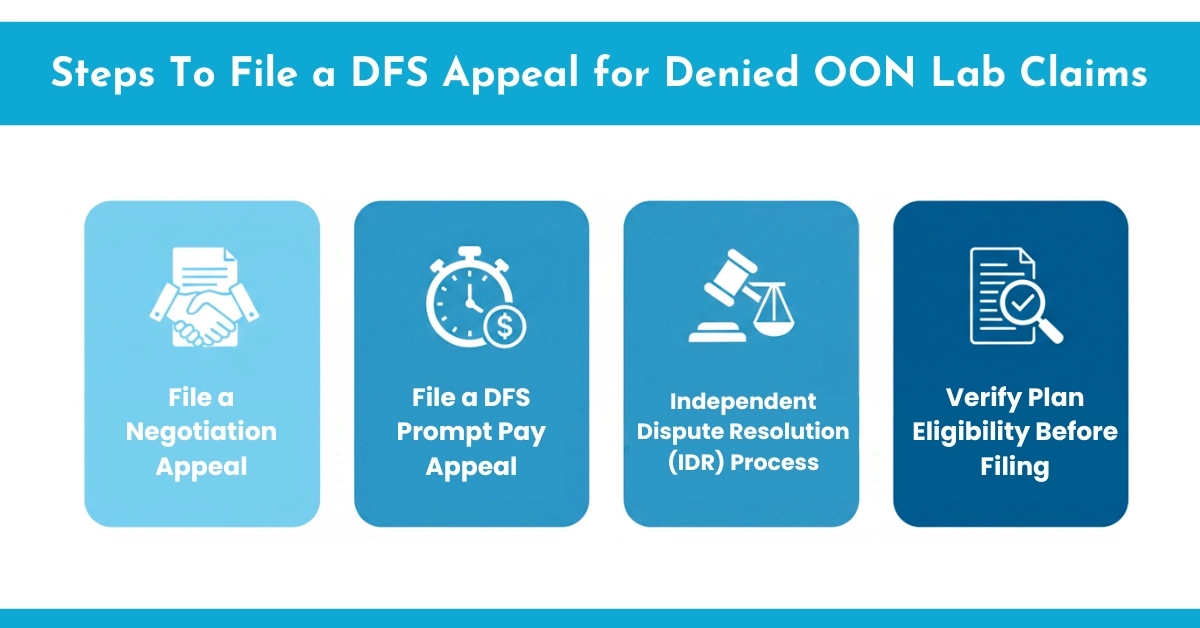

New York State provides a structured process to help OON labs recover owed payments, including DFS appeal for labs in NY, Prompt Pay appeals, and Independent Dispute Resolution (IDR). Labs that follow these processes with proper documentation see significantly higher success in reimbursement. HelloMDs helps laboratories navigate these steps efficiently, improving recovery rates and reducing delays, ensuring labs get the payments they are legally owed.

On OON lab is not contracted with a patient’s insurance plan. This setup can lead to higher reimbursements when things go right, but it often results in denied OON lab claims. In New York, many independent and specialty labs operate outside payer networks but still receive referrals from ambulatory surgical centers (ASCs), physician groups, or clinics.

Examples of codes used in OON lab billing:

Protections for labs:

Labs mostly experience underpayment due to:

Out-of-network labs in New York often face payment challenges, and Hello MDs’ “Medical Billing Services for Small Practices” highlights strategies for managing complex insurance claims efficiently. These insights are essential for navigating the DFS appeal for labs in NY and improving reimbursement success.

The DFS appeal (Department of Financial Services appeal) is New York’s external review system for health insurance disputes.

For labs, this often applies to denials based on:

DFS-appointed independent reviews evaluate the claim, supporting documentation. This process builds on federal protections like the No Surprises Act but is tailored to NY rules.

For more guidance in the IDR process in healthcare, HelloMDs provides step-by-step support for labs.

The first step after receiving an underpaid or denied claim is to initiate an open negotiation or first-level appeal with the payer. This communication is your opportunity to request a review and reconsideration.

A negotiation appeal must be submitted within 30 calendar days of receiving the Explanation of Benefits (EOB) or payment notice.

If the payer does not respond within 30 days or refuses to adjust payment, the next step is escalation through the DFS Prompt Pay system.

The New York Department of Financial Services (DFS) enforces the Prompt Pay Law, which requires insurers to pay “clean claims” within 45 days (for electronic) or 30 days (for paper claims). If your claim meets these standards but remains unpaid, you can file a DFS Prompt Pay complaint.

Submit a complaint via the official DFS Health Insurance Portal.

If payment is still unresolved, labs can file for Independent Dispute Resolution (IDR) under New York’s Surprise Bill Law. This system provides a neutral platform for reviewing payment disputes between insurers and out-of-network providers.

Before starting any appeal, confirm whether the insurance plan is state-regulated or self-funded (ERISA). This distinction determines whether DFS or Federal IDR applies.

Plan Type | Regulator | Eligible for NY IDR? |

State-Regulated (Fully Insured) | NY Department of Financial Services (DFS) | Yes |

Self-Funded / ERISA (Employer-Based) | Federal Department of Labor | No – Use Federal IDR |

Always check the member ID card or verify directly with the payer to prevent filing errors.

Proper documentation is the foundation of every successful OON appeal. Labs should maintain the following records for each case:

Maintaining a standardized documentation system helps prevent missed deadlines and strengthens your appeal.

Partnering with a specialized RCM service ensures faster claim resolution and accurate reimbursement.

HelloMDs provides end-to-end RCM healthcare services for labs navigating DFS appeals and OON claim disputes.

For out-of-network labs in New York, navigating the reimbursement system requires persistence, precision, and a strong understanding of state regulations. By following the three-tier process of negotiation, DFS appeal, and IDR, labs can recover underpaid claims while remaining compliant with New York law.

Maintaining detailed documentation, training your billing team, and leveraging RCM expertise of Hello Mds can transform the financial stability of your laboratory. When managed correctly, even complex OON disputes can result in fair payments and faster resolutions.

Information provided here is educational, not billing or legal advice. Consult official DFS and ICD-10 references for accurate guidance. Some examples or visuals are illustrative only.

Yes, they often do! Many people win appeals when they provide strong medical documentation and persistence. It’s all about clearly showing medical necessity and policy coverage.

It depends on the insurer, but most appeals take between 30 and 60 days. Sometimes, more complex cases can stretch longer if more evidence is needed.

Start by reviewing the denial letter carefully, gathering your medical documentation, and writing a clear appeal. Be polite, precise, and include doctor support if possible.

Good reasons include incorrect claim coding, medical necessity disputes, or miscommunication about coverage. If you believe the denial’s unfair, absolutely appeal—it’s worth trying!