Home / What Is ERA in Medical Billing?

In today’s fast-paced healthcare environment, efficiently managing payments is Important for keeping your practice running smoothly. If you have ever wondered what is ERA in medical billing, you are not alone. Millions of people face these things on a daily basis. It is a key component that helps you streamline the revenue cycle.

According to the Centers for Medicare & Medicaid Services (CMS), ERA transactions rely on the HIPAA-compliant ANSI X12 835 electronic format to standardize how insurers send payment information to healthcare providers. This standardization allows practices to automate payment posting, reduce errors, and reconcile accounts more efficiently.

As experts at HelloMDS, we see firsthand how adopting electronic processes can transform billing operations, allowing providers to focus more on patient care rather than paperwork.

The ERA stands for Electronic Remittance Advice. ERA meaning in medical billing, refers to an electronic document that payers send after adjudicating claims that explains how an insurance payer processed a medical claim, what was paid, and what was denied and why.

ERA enrollment with payers leaves practices reliant on slow paper processes. When practices struggle with delayed payments or posting errors that lead to incorrect patient balances, implementing ERA can resolve these persistent issues.

Key Components of an ERA File:

Every ERA in medical billing contains:

For example, an ERA for an office visit (CPT code 99213) with a diagnosis of Type 2 Diabetes (ICD-10 code E11.9) would precisely show the payment for that service and any applicable adjustments. This level of detail is crucial for accurate payment posting and financial reconciliation.

ERA, or Electronic Remittance Advice, is a key part of medical billing that details how insurance claims are processed and payments are applied. Just like accurate coding—such as using the correct ICD-10 codes for obesity—is essential for submitting clean claims, ERA helps ensure that these coded claims are paid correctly and efficiently, keeping the revenue cycle smooth

Did you know?

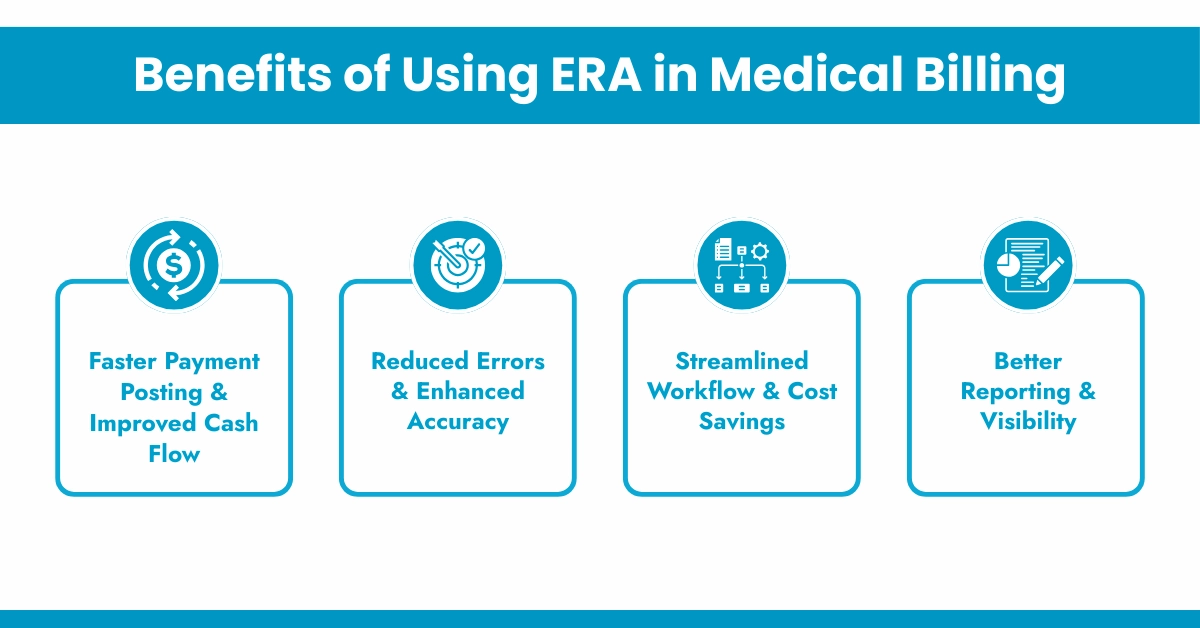

According to the American Medical Association (AMA), practices that adopt full ERA automation reduce payment posting time by up to 70%. That translates into real dollars saved on labor and faster patient balance billing.

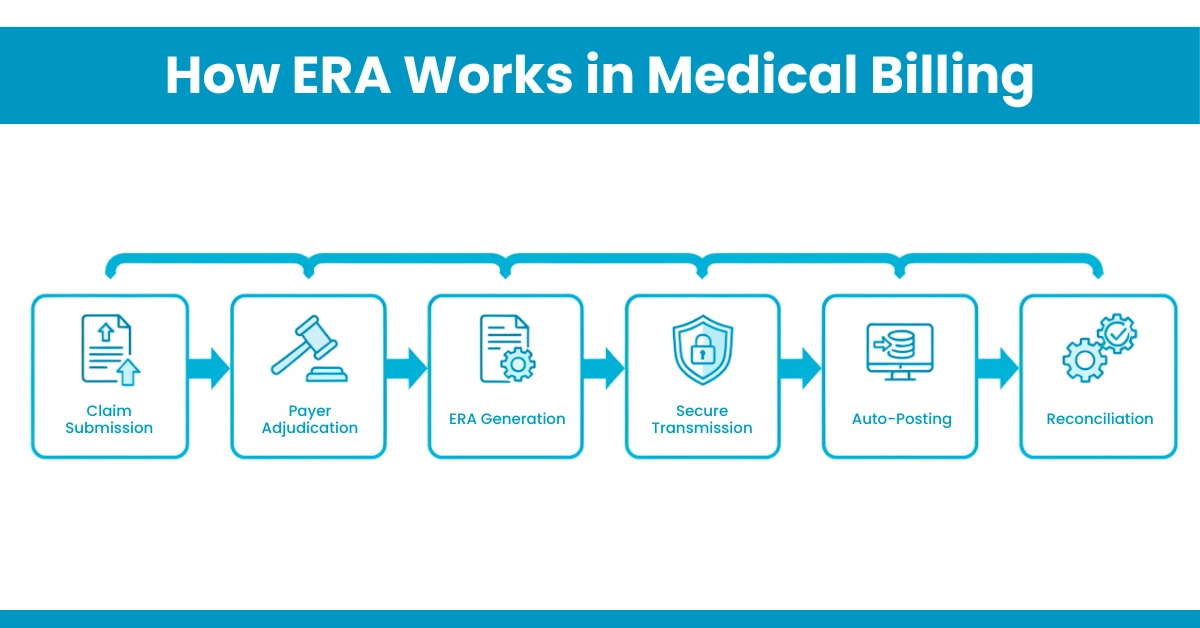

Understanding the ERA workflow helps practices identify and prevent cash flow bottlenecks. Here’s a step-by-step overview:

Hello MDs Tip:

Many practices enroll in ERA but fail to properly link EFT deposits. This can create reconciliation issues where payments are posted but not traceable to bank deposits. Proper ERA–EFT setup prevents this common problem.

The ERA benefits extend beyond speed. When you leverage optimized ERA processing, you unlock measurable improvements across your revenue cycle.

For Your Information: CMS mandates that all Medicare-enrolled providers accept ERA and EFT for many years. Yet, many small practices still rely on paper for commercial payers, missing out on efficiency gains

ERA is machine-readable, unlike Explanation of Benefits (EOB) paper-based. It arrives through secure Electronic Data Interchange (EDI) directly into your practice management system (PMS) or revenue cycle platform. Here is the complete difference between the ERA and EOB in a table.

Features | ERA | EOB |

Audience | Healthcare providers | Patients |

Format | Digital, ANSI X12 835 file | Traditional paper or PDF |

Readability | Machine-readable | Human-readable only |

Processing | Automated posting | Manual entry |

Use | Providers for billing | Patient for understanding |

Delivery | Directly send to the provider’s billing system | Mailed, sent to the patient’s home |

Error risk | Low | High |

Reconciliation | Tied to EFT for easy matching | Requires a manual bank comparison |

Reconciliation Tied to EFT for easy matching Requires a manual bank comparison

Did You Know: Practices relying solely on EOBs spend 3-5 times longer on payment reconciliation compared to those that use ERA. This efficiency gap explains why the ERA in medical billing has become the industry standard.

Even with its benefits, managing ERAs has challenges that many practices face:

To fully leverage ERA, consider these expert-recommended strategies:

Understanding what ERA in medical billing is and how to manage it effectively places your practice ahead in revenue cycle performance. ERAs streamline workflows, decrease errors, and unlock financial insights that drive better decision-making.

At Hello MDs, we specialize in medical payment posting, precise reconciliation, and comprehensive denial management that harnesses the full potential of ERA data. Partner with our certified experts to transform your billing process and reduce administrative burden while maximizing revenue.

Disclaimer:

This content is provided for general educational purposes only and does not constitute medical, legal, or billing advice. Providers should confirm coding, compliance, and reimbursement details using official ICD-10, CPT, and payer-specific guidelines. Visuals used may be illustrative or AI-generated and are not intended to represent actual patients or claims.

ERAs are commonly received as ANSI X12 835 electronic files through clearinghouses, payer portals, or directly integrated billing systems software.

Medical billing specialists or revenue cycle teams typically process ERAs, ensuring accurate posting, reconciliation with EFTs, and timely follow-up actions.

Understanding ERAs helps medical billers identify underpayments, resolve denials efficiently, maintain accurate patient balances, and protect practice revenue for long-term sustainability.

Medical billing software integrates ERAs within practice management systems, clearinghouses, and revenue cycle platforms for automated posting workflows and reconciliation.

A medical practice should start using ERAs as soon as payer enrollment is available to improve cash flow efficiency immediately.